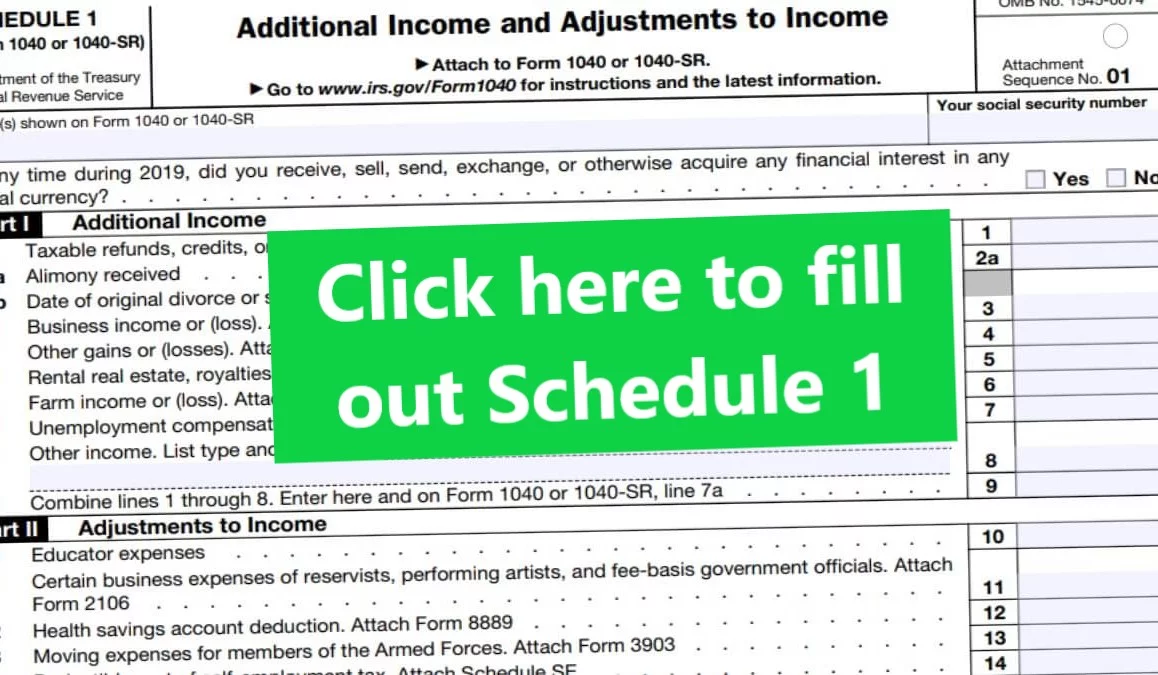

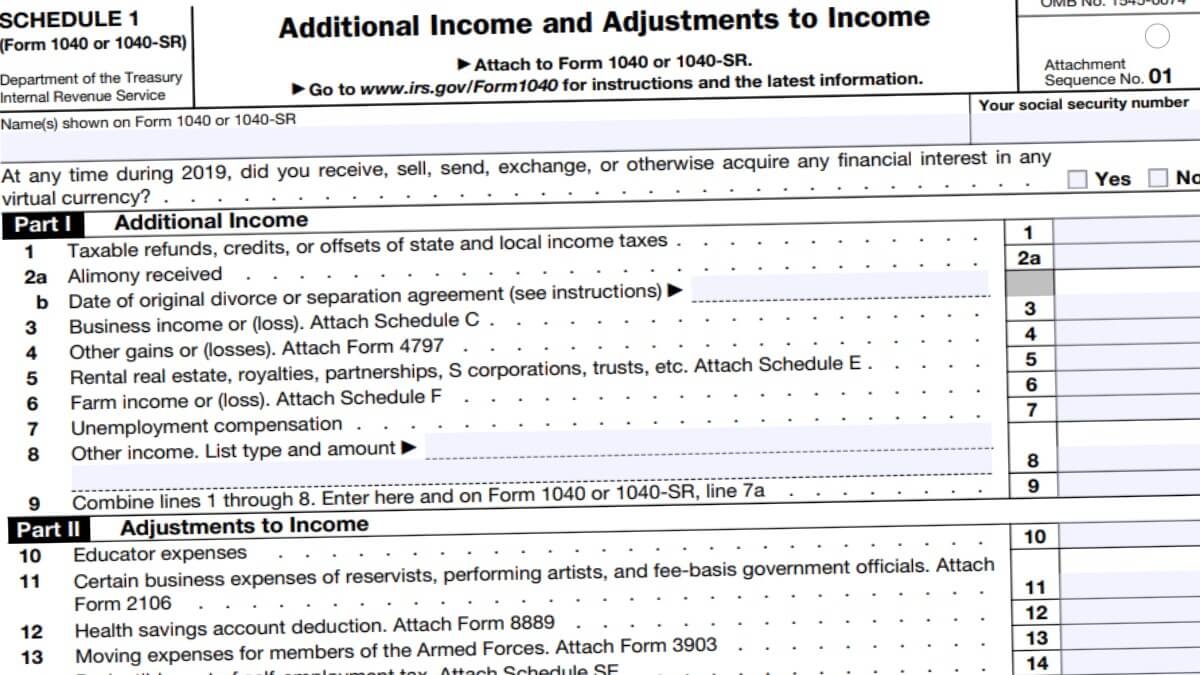

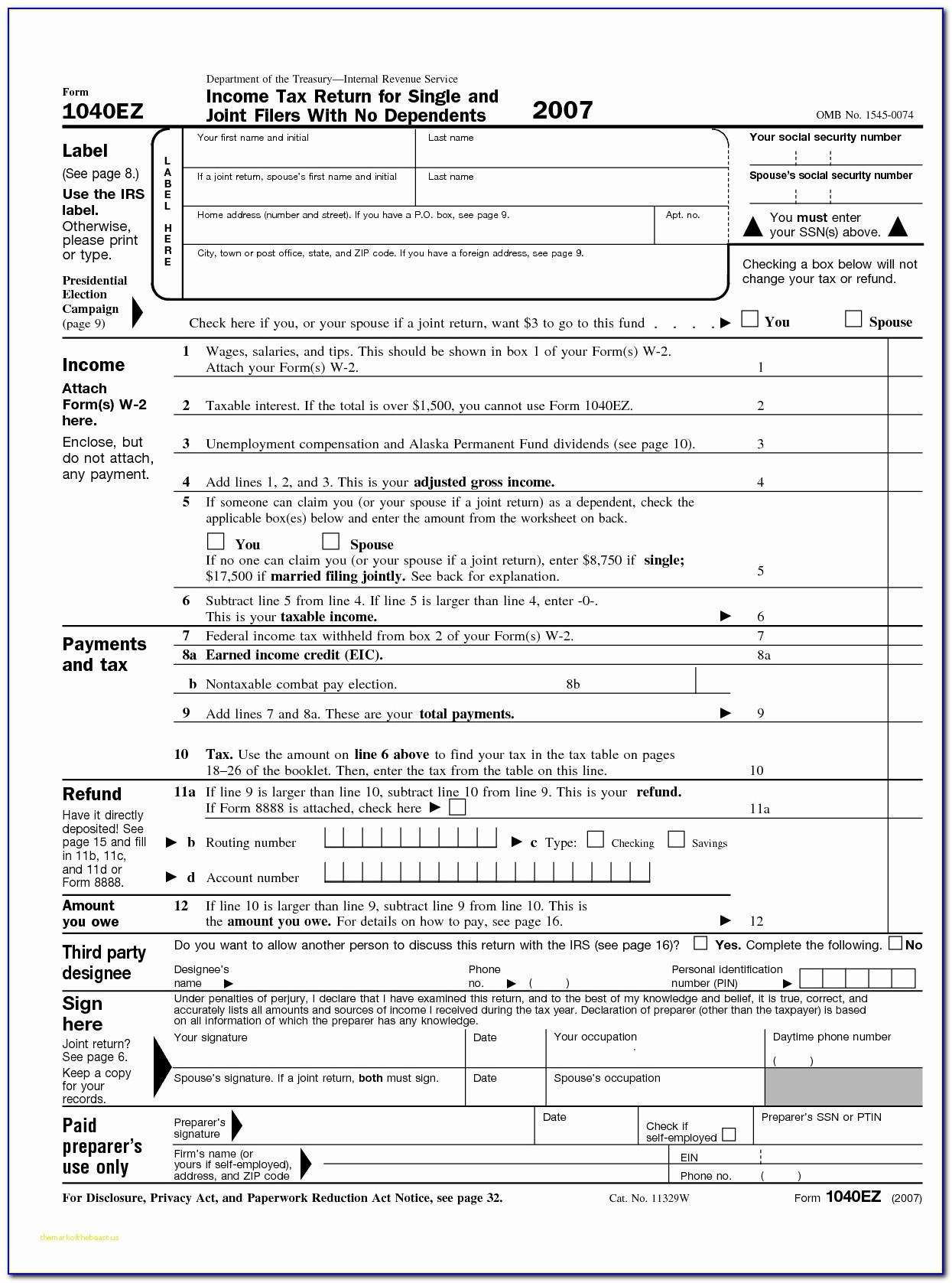

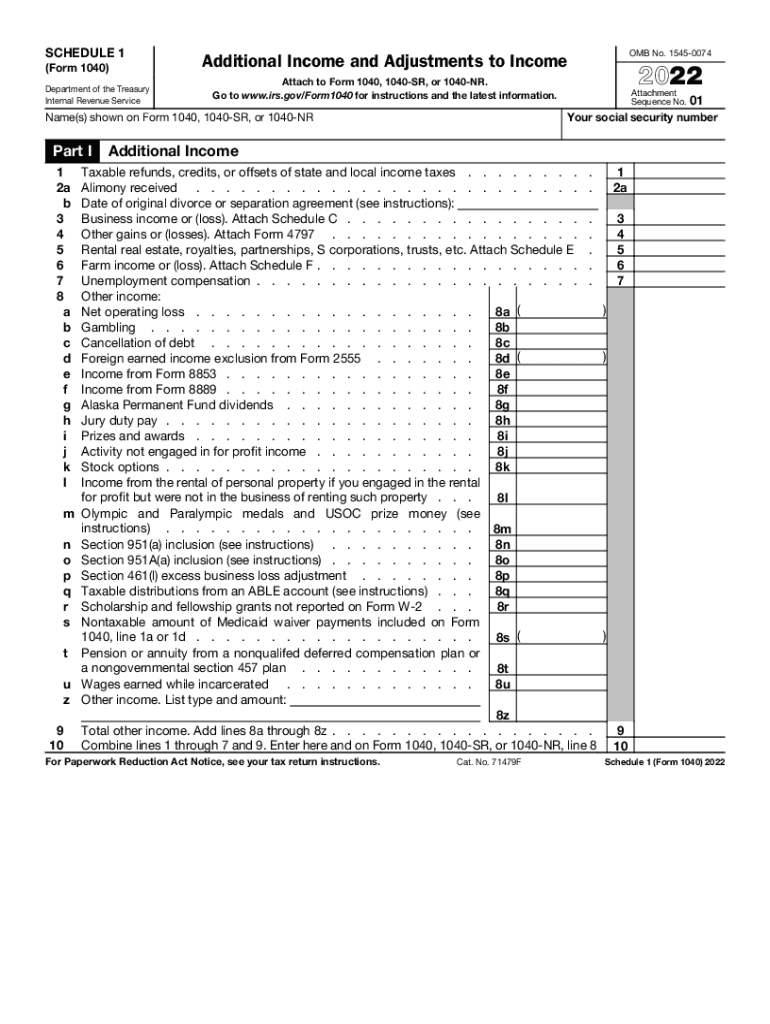

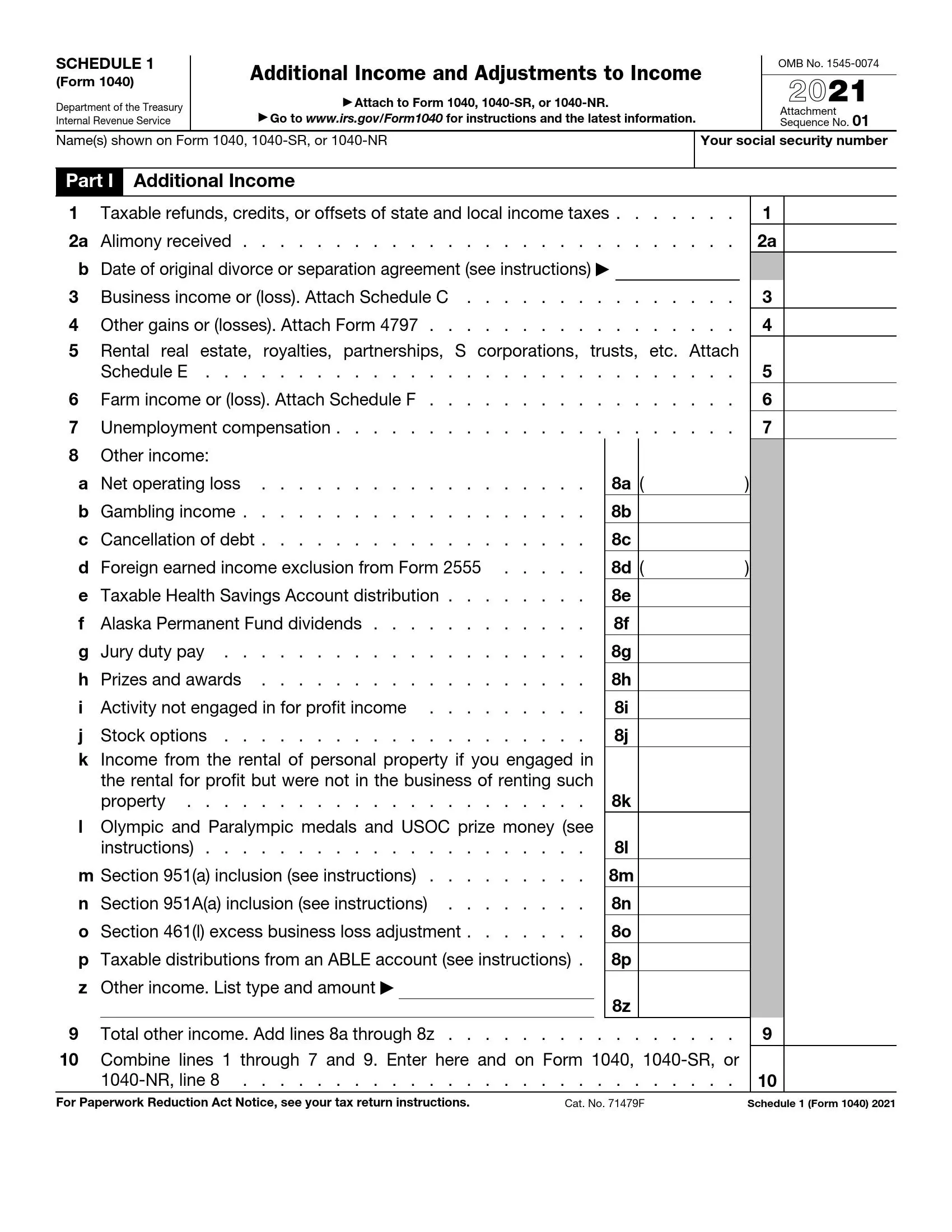

2025 Schedule 1 1040

2025 Schedule 1 1040 - The reforms created a mandate that all taxpayers use. We will update this page for tax year 2025 as the forms, schedules, and instructions become available. 2025 Schedule 1 1040. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). In its announcement tuesday, the agency raised the income thresholds for each bracket, which applies to tax year 2025 for returns filed in 2026.

The reforms created a mandate that all taxpayers use. We will update this page for tax year 2025 as the forms, schedules, and instructions become available.

1040 Schedule 1 2025 2025, The top rate of 37% applies to.

Form 1040 Instructions Booklet 2025 2025, Amounts to be withheld from payments made weekly, fortnightly, monthly and.

1040 Schedule 1 2025 2025, The due date for personal income tax filing is april 15, 2025, assuming you’re a calendar year filer and your tax year ends on dec.

1040 Schedule 1 2025 2025, The first relates to tips, which must be reported to your employer.

1040 Schedule 2025 Lilly Pauline, Amounts to be withheld from payments made weekly, fortnightly, monthly and.

1040SR Form 2025 2025, Calculate the tax to withhold from weekly, fortnightly, monthly or quarterly payments.

2025 Schedule 1 Form 1040 Ivonne Oralla, If you apply for an extension, you can.

2025 Schedule A Form 1040 Sr James Greene, We will update this page for tax year 2025 as the forms, schedules, and instructions become available.

2025 Schedule 1 Form 1040 Ivonne Oralla, The reforms created a mandate that all taxpayers use.

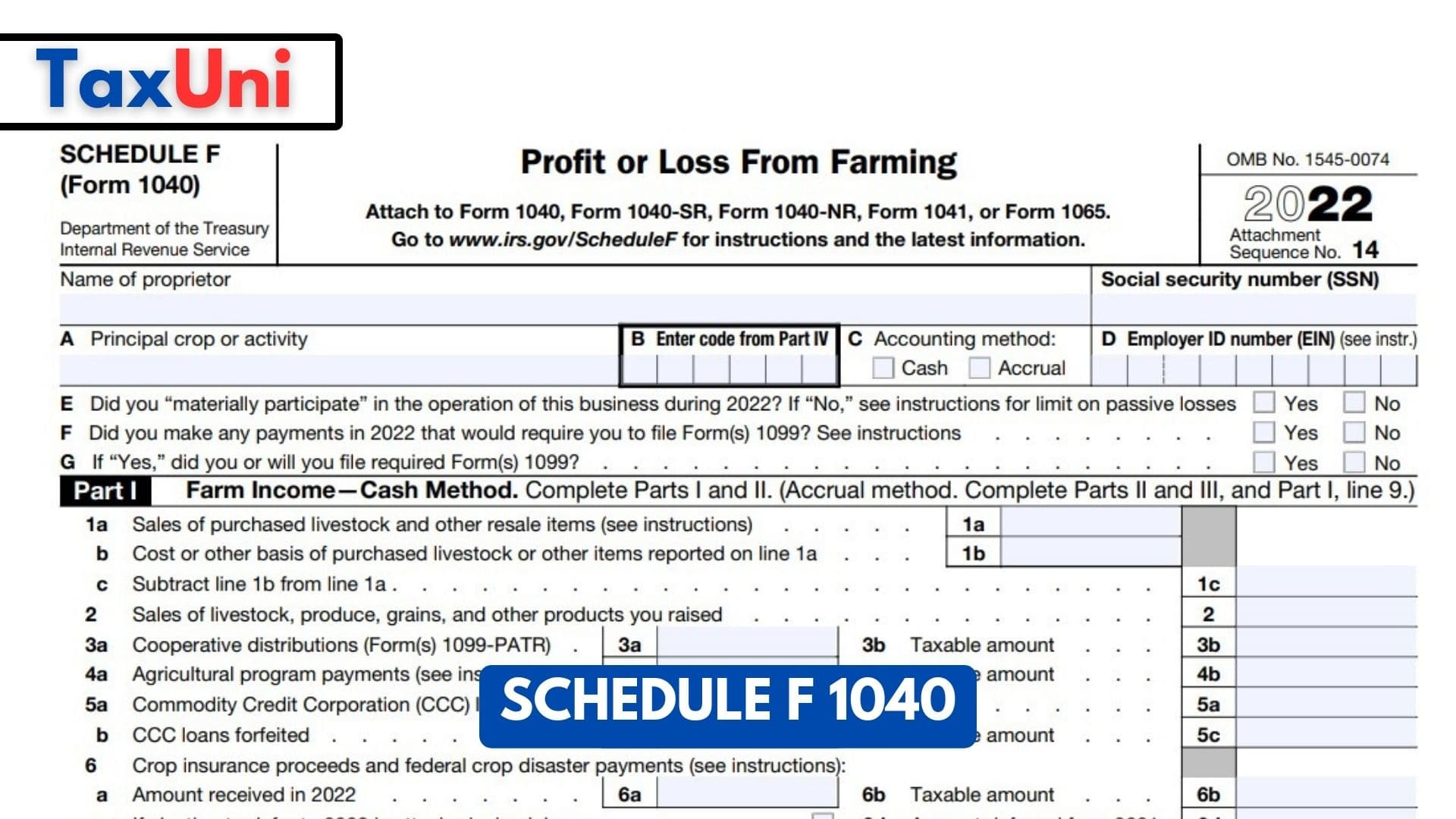

1040 Schedule 2025 Lilly Pauline, For details, see the following instructions and the schedule 1 instructions, especially the instructions for lines 1 through 7 and schedule 1, lines 1.